Enjoy a High Rate with a Term that Fits Your Life

Certificates of deposit (CDs) are a dependable way to save, offering a guaranteed interest rate over a fixed term.

At OMB Bank, we help Kansas City savers grow their money with secure, predictable CD options and a range of term lengths designed to support both short-term goals and long-term plans:

- Earn 4.00% APY* on a 7-month CD

- Earn 3.90% APY* on a 9-month CD

- Earn 3.80% APY* on a 13-month CD

- Earn 3.50% APY* on a 27-month CD

- $1,000 minimum deposit

- No setup or maintenance fees

In addition to our CD specials, Kansas City savers can lock in 4.11% APY* on a 3-month CD that automatically renews at a market-leading board rate every 90 days. Visit any of our KC branch locations to open yours today!

Checking Accounts

Whether you prefer a high interest rate, cash back or stock rewards, we have an account that's just right for you.

Savings Accounts

A major purchase, a rainy day, your retirement plans — whatever you’re saving for, we can help you get there.

CDs

Certificates of Deposit (CDs) are an easy and risk-free way to give your savings a guaranteed lift.

Money Market

Enjoy the liquidity of a checking account and the interest rates of a savings account in one versatile solution.

Level Up Your Business

Work directly with our experienced Treasury Services professionals to determine what banking products and services best suit your needs, plus make recommendations to help your business reach new heights.

Treasury Services at OMB offers these products & more:

- ACH origination including same-day & recurring payments

- Remote Deposit Capture

- Fraud protection with Positive Pay

- Insured Cash Sweep & CDARS

Start & Grow Your Business with the SBA

For everything from upgrading equipment and purchasing real estate to working capital for everyday expenses, count on an SBA-backed loan from OMB Bank.

Plus, as an SBA Preferred Lender, enjoy quicker processing times thanks to our SBA-granted authority to make final credit decisions on certain guaranteed loans. OMB is proud to offer the SBA's most popular loans for a wide range of business needs:

- Commercial real estate purchase

- Construction

- Business acquisition or expansion

- Equipment/inventory purchase

- Working capital

- Refinance debt

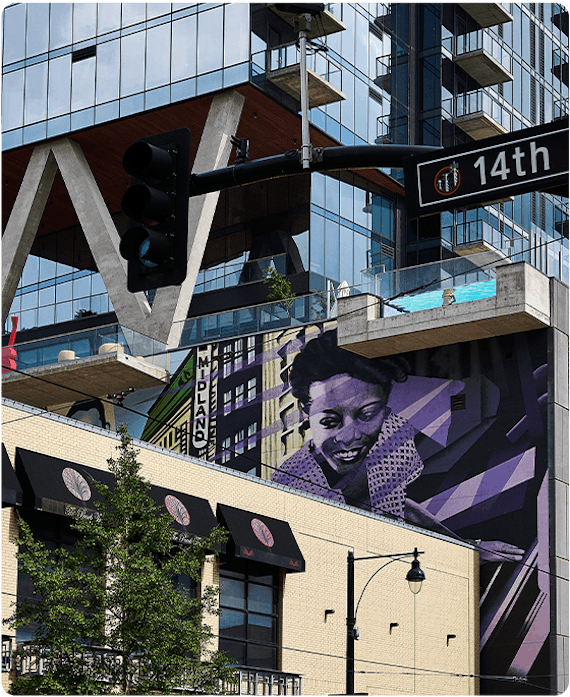

Meet Our Kansas City Team

From every branch lobby to the executive team, every member of Team OMB is invested in making our communities better. One customer and one interaction at a time. As a locally owned bank since 1999, we’re proud to say we know your name, know your story, and love your community — because it's our community, too.

Because We Live Here, Too

We are committed to providing the best banking experience for our community and to help build a bright future for all.

MONEY TIPS

How to Plan for Large Purchases Without Going into Debt

Large purchases can be exciting, but they can also put pressure on your finances if not carefully planned. The good news is that with the right strategy, it’s possible to prepare for big expenses without relying on high-interest debt.

How to Build an Emergency Fund from Scratch

Building an emergency fund is one of the smartest financial moves you can make. It provides a safety net for unexpected expenses, reduces stress and helps you avoid debt when life throws curveballs. In this comprehensive article, we’ll walk you through practical steps to create an emergency fund from the beginning - no matter your income or current savings - and provide strategies for staying consistent even when money is tight.

Why Local Businesses Choose OMB Bank for Treasury Services

At OMB Bank, Treasury Services is about more than numbers - it’s about people. Learn how your business could benefit and how community banking makes all the difference.

NEED HELP?

More helpWhat other business services are offered at OMB?

What are the ACH services offered?

How does business mobile banking work?

How do I apply for a business checking account?

Does OMB offer remote deposit capture to business customers?

Who is OMB Bank?

OMB Bank is a community financial institution with approximately $1.4 billion in total assets that operates with a steadfast commitment to empowering the communities we serve.